China Social Media Trends 2026: The Super-Apps Revolution

If you think that the Chinese digital landscape is simply a faster version of the West, then you are already behind. By 2026, China has evolved from a 'market' to a standalone digital operating system where China social media trends dictate global innovation. To international brands, 'going digital' in China is no longer about having a website in Chinese; it means fully embracing the 'Super App' infrastructure.

The Death of Friction: The "Closed Loop" Reality

In 2026, friction is the silent killer of conversion. If your customer has to leave an app to buy your product, you’ve already lost the sale. These shifting China led platforms like WeChat, Douyin, and Xiaohongshu to perfect the 'Closed Loop' model—a seamless, high-speed transition from discovery to payment that makes the 'external website' feel like a relic of the past.

Shoppertainment is the Standard

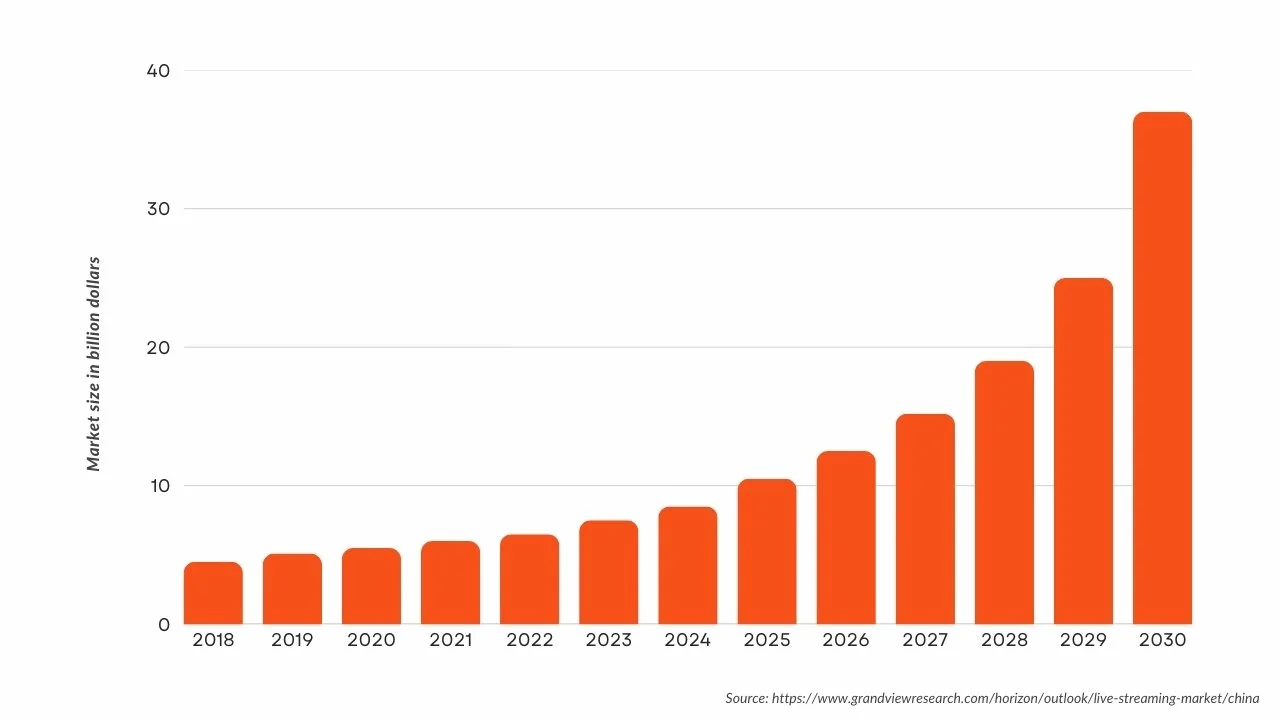

Livestreaming has matured from a flashy trend into the backbone of retail, projected to hit ¥8.16 trillion by 2026. WeChat Channels (微信视频号 Shipinhao) and Douyin now drive nearly 40% of all digital sales. Shopping is no longer a conscious action. It’s something that unfolds naturally during entertainment, powered by real-time engagement and instant, one-tap gratification.

China Livestreaming market size (2018-2030)

The Mini-Program Supremacy

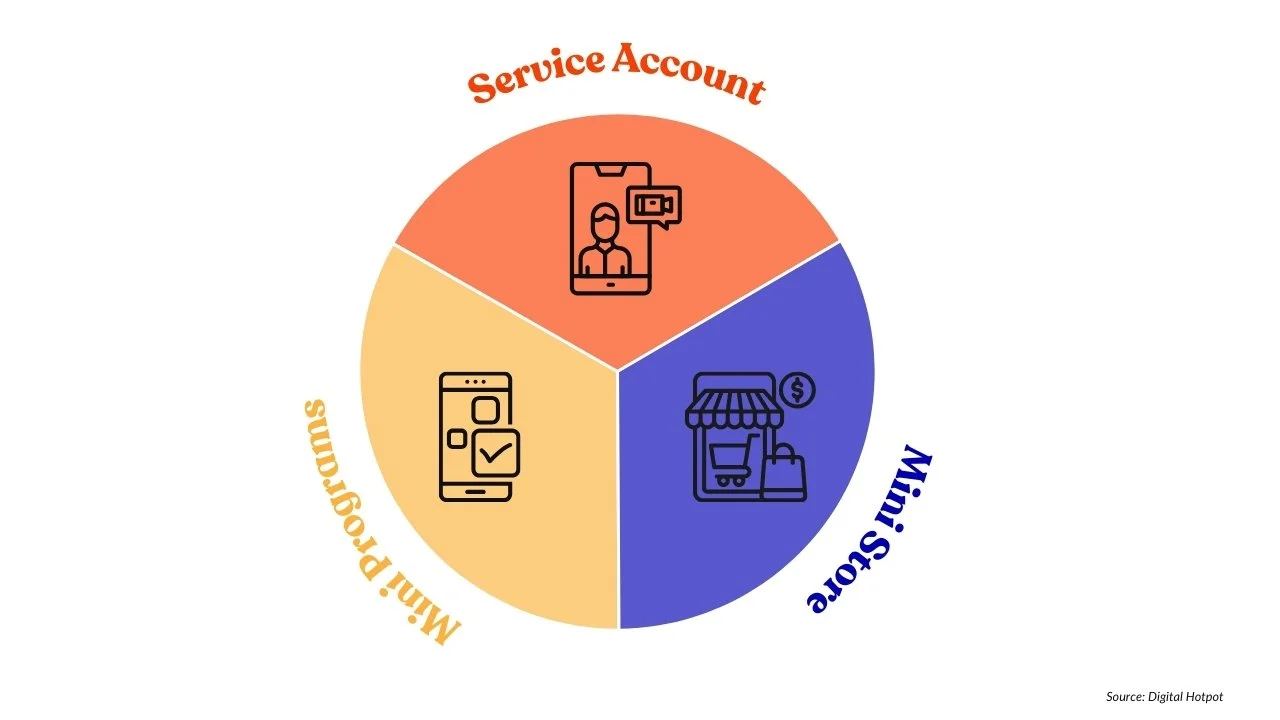

Brands are officially trading clunky traditional websites for WeChat Mini-Programs. These lightweight, "apps-within-the-app" are the new flagship stores. They handle everything: AI-personalized catalogs that predict user needs, biometric payments via WeChat Pay, and real-time logistics tracking—all without the user ever hitting a "back" button.

If you’re looking for a deeper dive into the specific mechanics of these platforms, we’ve already covered this topic in detail in a blog post about “WeChat Trinity”.

WeChat Trinity

Trust 2.0: From Celebrity Reach to Community Credibility

The era of the 'Mega-KOL' is fading into the background as trends shift toward radical transparency. In 2026, authenticity is the only currency that scales, and high-budget celebrity endorsements are being replaced by the 'human touch' of relatable peers.

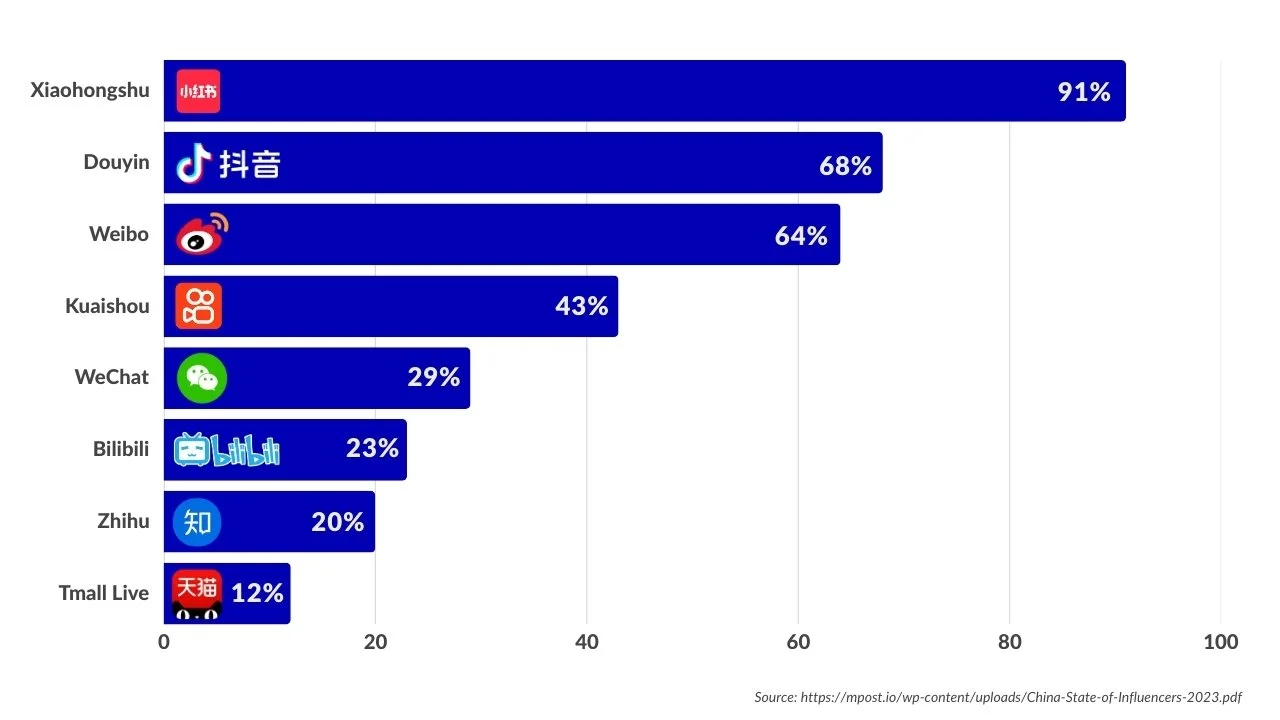

Xiaohongshu (RED) as China Social Media trends Filter

RED has evolved into the ultimate "barometer of trust" and the primary search engine for lifestyle decisions. Savvy consumers now prioritize reviews from KOCs (Key Opinion Consumers)—real users with smaller followings but massive engagement rates (often 3-5x higher than top-tier KOLs). They don't want an ad; they want a recommendation from a "digital friend."

Most popular China social media platforms among Influencers.

AI-Driven Hyper-Personalization

AI is no longer a buzzword; it’s the invisible infrastructure. In 2026, algorithms analyze social sentiment in milliseconds, allowing brands to adjust their offers instantly to match the "vibe" of specific micro-communities. This is GEO (Generative Engine Optimization)—optimizing your content so that AI search engines on RED or Doubao recommend you as the trusted solution to a user’s specific problem.

Protecting Margins with "Private Domain" (Private Traffic)

As acquisition costs on open marketplaces like Tmall skyrocket—sometimes exceeding $140 per customer in tier-1 cities—2026 is officially the year of the Private Domain. Brands are shifting focus from winning temporary "likes" to owning long-term Lifetime Value (LTV).

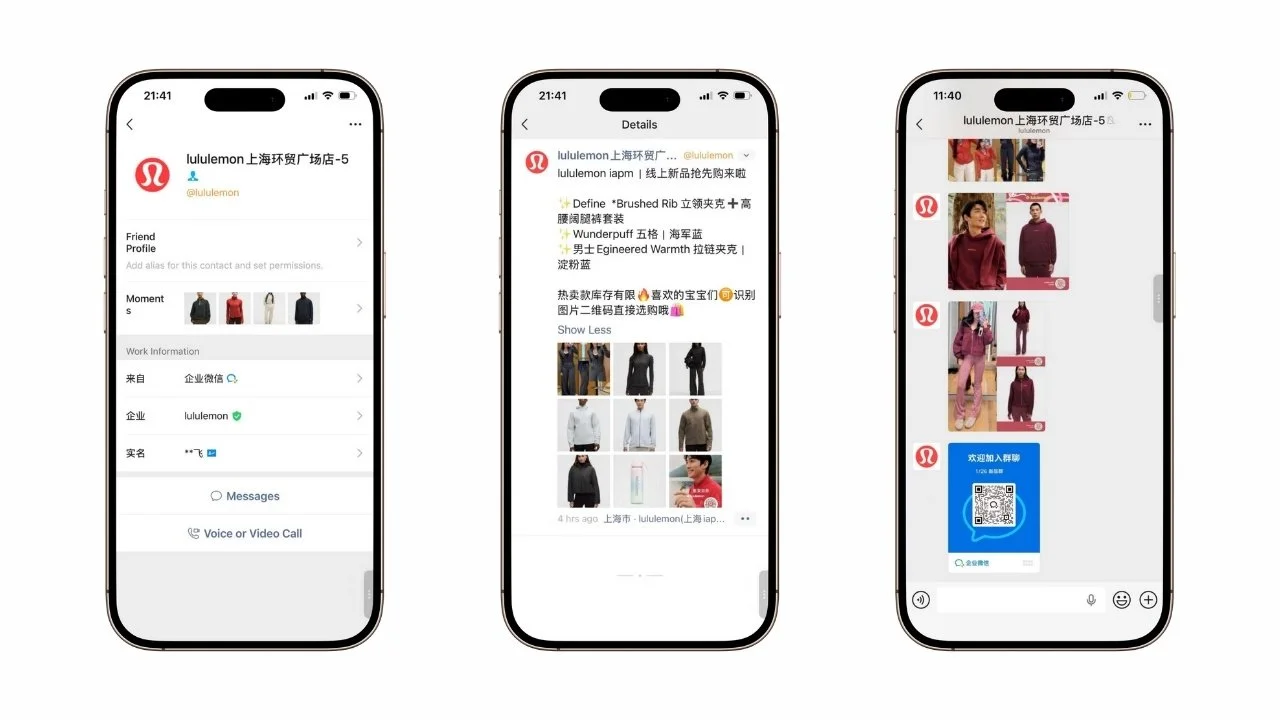

An example of a WeCom profile on WeChat and of a 1:1 conversation

The WeCom Revolution

Using WeCom (the enterprise version of WeChat), brands migrate customers from expensive public feeds into private chat groups and 1-on-1 "clienteling" relationships. This isn't just about sending coupons; it’s about architecting a dedicated brand community.

Human-Centric Selling

This allows for a "high-touch" relationship at scale. Instead of spending budget on repetitive ad impressions, you provide personalized styling, exclusive product drops, and direct human support. By integrating WeCom with local CRMs, brands can automate these journeys, turning a one-off buyer into a brand evangelist without the middleman tax.

The Gateway: Cross-Border E-Commerce (CBEC)

The good news for international brands? Entry barriers have never been lower. The expansion to over 165 CBEC pilot zones by 2026 allows foreign brands to sell directly to Chinese consumers without the legal and financial burden of a local entity.

China’s Integrated Pilot Zones for Cross-border E-commerce

With preferential tax rates (often 70% of standard VAT/tariffs) and streamlined customs, CBEC is the ultimate "sandbox." Brands can use bonded warehouses to offer "local-speed" delivery while maintaining global operations. It’s the perfect way to build data and prove product-market fit before committing to a full-scale physical launch.

The Verdict: Adaptive or Extinct?

Success in China in 2026 requires a "China-First" mandate. You cannot simply translate a global campaign; you must build within the Super-App walls. The market rewards those who move at the speed of social and punishes those who wait for the "traditional" path.

Your 2026 Checklist:

Master Video-Commerce: Make WeChat Channels and Douyin your primary storytelling engines.

Own Your Data: Build a Private Domain via WeCom to reclaim your margins and build real loyalty.

Optimize the Loop: Kill every extra click. Ensure the journey from "seen" to "bought" takes less than three seconds.

Don’t step into the China of 2026 unprepared. The digital landscape moves at a pace that rewards the agile and leaves the hesitant behind. To help you navigate this transition, we’ve developed a specialized series of deep-dive articles that break down exactly how to promote your business and thrive within the Super-App ecosystem. Explore our resources and turn these 2026 trends into your brand’s competitive advantage.